The rapid rise of artificial intelligence has created an equally powerful demand for the physical infrastructure that supports it. Behind every large language model and AI application lies a complex network of data centers, cooling systems, and storage arrays consuming vast amounts of power. Recent corporate earnings and industry reports show that the build-out of AI-related infrastructure is already well underway, marking a notable shift in capital spending across technology and real estate sectors

Powering the AI Era

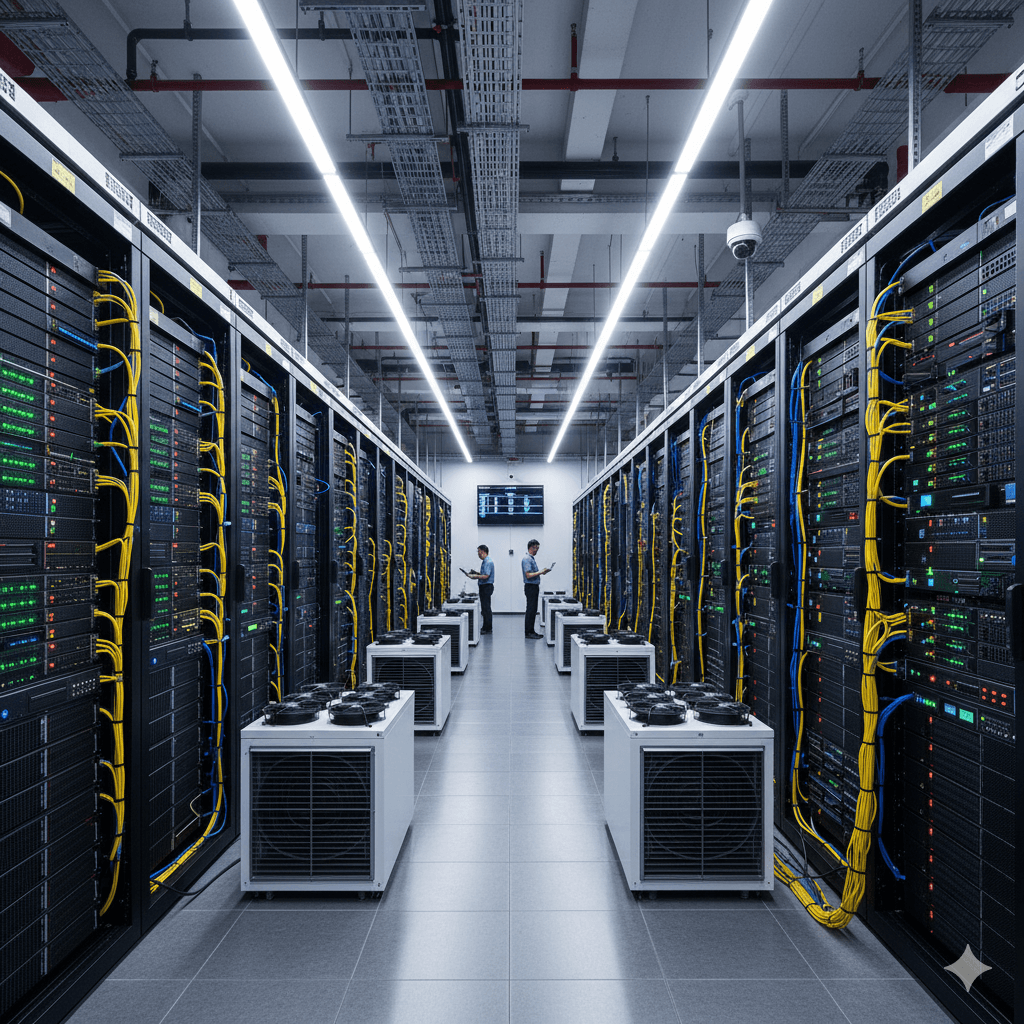

AI workloads differ sharply from traditional computing tasks. Training advanced models requires many times the electrical power and heat management capacity of conventional servers. This has made energy density and cooling efficiency central issues in data center design. The shift toward racks drawing over 40 kilowatts of power each—up from the typical 5 to 10 kW in older facilities—has driven rapid adoption of liquid-cooling technologies once considered niche. These infrastructure needs have set the stage for a new class of industrial growth centered around energy, space, and data capacity

Digital Landlords Benefit From Structural Demand

Real estate investment trusts specializing in data centers have emerged as key beneficiaries of this trend. Equinix (NASDAQ: EQIX), which operates more than 270 interconnected data centers worldwide, recently reported 11% year-over-year growth in Adjusted Funds From Operations, a key REIT performance measure. The company’s recurring lease model and established global footprint provide reliable income streams in a market where power and land scarcity are becoming strategic advantages. Iron Mountain (NYSE: IRM), traditionally known for records management, has also expanded into data infrastructure. Its data center segment posted 24% revenue growth in the most recent quarter and now has more than 1.3 gigawatts in its development pipeline

Technology Suppliers Capture Rising Orders

The companies manufacturing the hardware that powers these facilities are experiencing a parallel surge. Vertiv (NYSE: VRT), which provides electrical and cooling systems for high-density AI servers, reported a 60% year-over-year jump in organic orders and a backlog exceeding $9 billion. Meanwhile, Pure Storage (NYSE: PSTG) continues to expand its all-flash storage business, with subscription-based recurring revenue rising 18% to $1.8 billion. Both firms are positioned at the intersection of rising energy requirements and the need for faster, more efficient data access

Energy Constraints and Competitive Moats

A shortage of grid-scale power has become one of the industry’s defining challenges, influencing where and how data centers can be built. Analysts note that operators such as Equinix and Iron Mountain that have secured long-term power purchase agreements enjoy a structural advantage in expanding capacity. At the same time, efficiency-focused suppliers like Vertiv and Pure Storage are seeing stronger demand for technologies that maximize performance within existing power limits.

The accelerating need for physical infrastructure highlights the tangible backbone of the AI revolution. From the “digital landlords” of data centers to the suppliers of power, cooling, and storage systems, the sector reflects a fundamental reshaping of industrial investment priorities. Rather than a distant concept, the AI infrastructure boom is unfolding in real time across both technology and real estate markets.